Calaamadaha la kasbaday ee Gate.io

Ku saabsan Tokenyada Leveraged

Gate.io waxay soo bandhigtay ETF leveraged tokens. Farqiga kaliya ee u dhexeeya calaamadaha la xoojiyey iyo calaamadaha dhaqameedku waa in calaamadaha la faa'iidaysto ay leeyihiin hanti faa'iido leh. Dhammaan calaamadaha leveraged waxay leeyihiin dhiggooda suuqa ganacsiga goobta. Alaabooyinka ETF waxaa lagu ilaaliyaa laguna maareeyaa qandaraasyo joogto ah. Kharashka maamulka maalinlaha ah ee 0.1% ayaa la dalacayaa. (Qiimaha khidmadda maamulka ayaa ku kala duwan qiimaha dhabta ah. Fadlan tixraac Ogeysiisyada macluumaadka ugu dambeeyay). Kharashyada maaraynta waxay ka kooban yihiin kharashyada sida kharashka maaraynta qandaraaska iyo kharashyada maalgelinta, halka kharashka maalgelinta qandaraaska aan la dalacin. Iyada oo loo marayo hagaajinta maaraynta raasumaalka, isticmaalayaasha kharashyada faa'iidada dhabta ah iyo khataraha waa la dhimay.

Isticmaalayaashu uma baahna inay ballan qaadaan dammaanad marka ay ka ganacsanayaan calaamadaha leveraged, laakiin ETF-yadu waxay ku kici doonaan khidmadaha maaraynta maalinlaha ah 0.1% ( khidmadaha maaraynta waxaa laga soo ururiyaa lacagaha maamulka oo aan si toos ah uga muuqan ganacsiyada isticmaalayaasha). Calaamadaha la kasbaday waxay asal ahaan u dhigmaan heshiisyada joogtada ah, kuwaas oo sidoo kale si ku habboon loo fahmi karo inay yihiin goob ganacsi. Marka la barbardhigo ka-qaybgalka tooska ah ee ganacsiga qandaraasyada joogtada ah, calaamadaha la-xoojiyey waxay ku dadaalayaan inay wanaajiyaan maareynta raasumaalka si loo yareeyo kharashyada iyo khatarta dhabta ah ee isticmaalayaasha. Calaamadaha la kasbaday ayaa weli loo kala saaray inay yihiin alaab khatar sare leh. Fadlan hubi inaad fahantay khataraha ka hor inta aanad ka ganacsan calaamadaha leveraged.

Calaamadaha leveraged ETF

3L: 3-jeer calamada bullish dheer ee 3-jeer leveraged

Tusaalaha: ETH3L waa 3-jeer leveraged dheer bullish token ETH.

3S: 3-wakhti leveraged gaaban calaamada

tusaale: ETH3S waa 3-jeer leveraged bearish gaaban calaamadda ETH.

Habka hagaajinta booska ee calaamadaha la xoojiyey

Marka alaabada ETF ay raacaan faa'iidada iyo khasaaraha oo ay ku hagaajiyaan kabbashada dib u habeynta leverage maalin kasta, haddii macaash la sameeyo, boosaska waa la furi doonaa; haddii ay jiraan khasaare, boosaska waa la dhimi doonaa. Wax dammaanad ah oo loo baahan yahay ganacsi calaamo ah looma baahna. Iibka fudud iyo iibinta calaamadaha la xoojiyey, isticmaalayaashu waxay dhalin karaan faa'iidooyin leveraged, sida ganacsiga margin.

Xeerarka 3X leveraged ETF

1. Dib-u-habaynta aan joogtada ahayn: Marka saamiga leverage-ka waqtiga-dhabta ah uu dhaafo 3, dib-u-dheellitirka aan joogtada ahayn ayaa kicin doona iyo habka hagaajinta booska ayaa hagaajin doona saamiga leverage ilaa 2.3.

2. Dib-u-habaynta joogtada ah: 00:00UTC+8 maalin kasta waa wakhtiga dib-u-dheellitirka caadiga ah. Marka saamiga leverage-waqtiga-dhabta ah uu ka hooseeyo 1.8 ama ka sarreeya 3, ama heerka isbedbedelku (oo lagu xisaabiyo qiimaha qandaraaska) uu ka sarreeyo 1% (sababtoo ah koror weyn ama hoos u dhac ku yimid qiimaha sarifka lacagaha ee 24-kii saac ee la soo dhaafay), booska Habka hagaajintu wuxuu hagaajin doonaa saamiga leverage ilaa 2.3.

3. The 3-time leveraged ETF waxay leedahay faa'iido la beegsanayo oo ah 2.3 jeer ficil ahaan, dadaalka lagu dhimayo heerka isbedbedelka suuqa oo la yareeyo kharashyada khilaafka muddada-dheer. Suuqa hal dhinac ah, sababtoo ah faa'iidada la sameeyay waxaa loo isticmaali doonaa in lagu daro jagooyin badan iyo joojinta-khasaaraha ayaa kicin doona marka khasaaraha la galo, alaabada ETF waxay u muuqan doontaa inay si fiican u shaqeyneyso, laakiin kharashka khilaafku wuxuu noqon karaa mid daran sababtoo ah isbeddelada suuqa. Sidaa darteed, alaabooyinka ETF waxay u fiican yihiin xayndaabyada muddada-gaaban halkii ay ka ahaan lahaayeen haynta muddada dheer.

Xeerarka 5X leveraged ETF

1. Dib-u-habaynta aan joogtada ahayn: Marka saamiga leverage-ka waqtiga-dhabta ah uu dhaafo 7, dib-u-habaynta aan joogtada ahayn ayaa kicin doonta iyo habka hagaajinta booska ayaa hagaajin doona saamiga leverage ilaa 5

. waa wakhtiga dib-u-dheellitirka caadiga ah. Marka saamiga leverage-waqtiga-dhabta ah uu ka hooseeyo 3.5 ama ka sarreeya 7, ama heerka isbedbedelku (oo lagu xisaabiyo qiimaha qandaraaska) uu dhaafo 1% (sababtoo ah koror weyn ama hoos u dhac ku yimid qiimaha sarifka lacagaha ee 24-kii saac ee la soo dhaafay), booska Habka hagaajintu waxa uu isku hagaajin doonaa saamiga leverage ilaa 5

. Macquul ahaan, isku dheelitir la'aanta joogtada ah iyo dib-u-habaynta joogtada ahi waxay si joogto ah ugu dhacdaa alaabooyinka ETF ee 5-waqtiga ah, kuwaas oo sidoo kale la ildaran khilaaf ka badan 3-wakhti alaab ETF ah oo kaliya oo u fiican xayndaabyada muddada-gaaban. Kahor intaadan maalgelinin alaabada leveraged ETF, fadlan lagu wargeliyo faraqa u dhexeeya 5X iyo 3X calaamado leveraged oo dooro si caqli leh.

Faa'iidooyinka calamadaha la kasbaday

oo ka xor ah dareerinta

Calaamadaha leveraged waxay asal ahaan ka yihiin lammaane calaamo ah oo suuqa ku jira sidaas darteedna way ka madax bannaan yihiin dareere. Xataa haddii qiimaha calaamada leveraged uu hoos uga dhaco 100USD ilaa 1 USD, tirada uu ganacsaduhu hayo isma beddeli doono. Haddii khasaare badan la gaarey, waxay kicin kartaa habka dhimista booska tooska ah. Xaalado naadir ah oo keliya, qiimaha calaamadaha la xoojiyey ayaa laga yaabaa inuu u dhawaado 0.

Looma baahna dammaanad

ganacsi ganacsi margin ah, dammaanad waa qasab ganacsatada si ay u abuuraan faa'iidooyin la faa'iido leh, taas oo lagu gaari karo ganacsiyo leveraged calaamado aan dammaanad lahayn. Lacag maamul oo gaar ah ayaa lagu dalaci doonaa.

Debaajiga iyo ka-noqoshada calaamadaha ETF-ka ee leveraged weli suurtagal maaha.

Isku-darka faa'iidada tooska ah iyo hoos u dhigista booska tooska ah

Marka ay jirto kor u kac hal dhinac ah oo suuqa ah, 3X calaamadaha leveraged waxay dhalin karaan faa'iido badan marka loo eego ganacsiga margin caadiga ah ee leh 3X leverage. Sababta tan ayaa ah in faa'iidada la sameeyo si toos ah loo isticmaalo si loo iibsado calaamado badan oo faa'iido leh si loo soo saaro faa'iido badan. Marka suuqu dhaco, dareere ma dhacayo oo dhimista booska tooska ah ayaa la kicin doonaa halkii la joojin lahaa khasaaraha.

Khasaaraha calamadaha la kasbaday

Khatarta saraysa

Calaamadaha la kasbaday waa badeecooyin cusub oo leh sifooyin leveraged, kuwaas oo leh khataro badan.

Kuma fiicna maalgashiga muddada-dheer

Calaamadaha Leveraged waxay ku habboon yihiin maalgashadayaasha xirfadlayaasha ah inay u isticmaalaan khatarta khatarta ah ama maalgashiga suuqa ee muddada-gaaban. Kuma haboona maalgashi dhex dhexaad ah iyo mid fogba. Sababtoo ah jiritaanka habka hagaajinta booska, khatarta ah in la hayo calaamadaha leveraged muddo dheer waa mid aad u sarreeya. Markasta oo ay dheeraato wakhtiga haynta, way sii weynaanaysaa isbedbedelka iyo kharashyada is jiid jiidka.

Kharashka Maareynta Maalgelinta

Kharashyada maalgelinta ee qandaraasyada joogtada ah waxaa bixiya ganacsatada dhinacyada ka soo horjeeda ee heshiiska, laakiin marka la ganacsado calaamadaha leveraged qiimaha maalinlaha ah ee kharashka maaraynta waxaa lagu dallaci doonaa: khidmadda maamulka maalinlaha ah ee 0.1% ayaa la dalacayaa.

Dhammaan macluumaadka kor ku xusan maaha wax talo ah oo ku saabsan maalgashiga. Calaamadaha leveraged waa alaab khatar sare leh. Fadlan hubi in aad si fiican u fahantay khataraha ka hor inta aanad ka ganacsan calaamadaha leveraged.

Fadlan la'aanteed:

Suuqa cryptocurrency waa mid kacsan. Alaabooyinka 3X iyo 5X leveraged ETF waxay kordhin doonaan isbeddelka qiimaha waxayna keenayaan khataro badan oo khasaare ah. Fadlan hubi inaad si faahfaahsan u fahanto khataraha oo aad si xikmad leh uga ganacsato. Sababtoo ah hagaajinta boosaska joogtada ah iyo kuwa aan joogtada ahayn, kor u kaca iyo hoos u dhaca wakhti go'an mar walba ma aha faa'iidada la beegsanayo. Alaabooyinka ETF waxaa lagu ooday qandaraasyo weligeed ah. Haddii faa'iido la helo, boosaska waa la furayaa; haddii ay jiraan khasaare, boosaska waa la dhimi doonaa. Alaabooyinka ETF waxay la socdaan faa'iidada iyo khasaaraha waxayna hagaajiyaan faa'iidada dib ugu noqoshada leverage-ka la beegsanayo maalin kasta. Kharashyada kala go'a waxay noqon karaan kuwo aad u badan marka la eego suuqa isbedbeddelaya. Sababtoo ah habka hagaajinta booska iyo kharashyada haynta booska, alaabada ETF ee leveraged maaha maalgashi wanaagsan oo waqti dheer ah. Isbeddellada qiimaha waaweyn iyo khatarta sare waa sifooyinka alaabta ETF. Fadlan si taxadar leh u maalgashada

Hagaha Alaabta ETF Leveraged (Cutubka I)

Q1: Maxay yihiin alaabooyinka ETF ee leveraged?

Calaamadaha la xoojiyey waxay la mid yihiin badeecadaha caadiga ah ee ETC ee suuqa saamiyada. Waxay la socdaan isbedbedelka qiimaha hantida la beegsaday.

Isbeddelladan qiimaha ayaa ku saabsan 3 ama 5 jeer ka suuqa hantida hoose. Si ka duwan ganacsiga margin caadiga ah, isticmaalayaashu uma baahna inay ballan qaadaan dammaanad marka ay ka ganacsanayaan calaamadaha

Isticmaalayaashu waxay ku gaari karaan ujeeddada ganacsi ee margin iyagoo si fudud u iibsanaya iyo iibinta calaamadaha la faa'iidaysto.

Alaab kasta oo ETF ah oo leveraged waxay u dhigantaa booska qandaraaska, kaas oo ay maamulaan maareeyayaasha maalgelinta.

Isticmaalka alaabada ETF ee leveraged waxay kuu ogolaaneysaa inaad si fudud u dhisto faylalka maalgashigaaga joogtada ah adigoon wax ka baran hababka gaarka ah.

Q2: Waa maxay hantida hoose?

J: Magaca badeecada ETF ee leveraged wuxuu ka kooban yahay magaca hantideeda hoose iyo saamiga leverage. Tusaale ahaan, hantida hoose ee BTC3L iyo BTC3S waa BTC.

Q3: Waa imisa tirada guud ee alaabta ETF?

Si la mid ah qandaraasyada joogtada ah, alaabada ETF ee leveraged ayaa ah derivative dhaqaale, ma aha calaamadaha crypto caadiga ah. Markaa ma jiraan "mugga guud" ama "mugga gubtay" ee alaabooyinka ETF ee leveraged

Q4 : Sidee

badeecadaha ETF ee leveraged u kordhiyaan faa'iidooyinkakor u kaca by 5%, (aan la tixgelin in ay suurtogal tahay in dib-u-habaynta aan caadiga ahayn soo kicinta), qiimaha BTC3L kici doonaa 15% iyo BTC3S hoos u dhici doona 15

%

.

Waa in la kordhiyo faa'iidada iyo khasaaraha iyada oo lagu daro deynta margin wadarta guud ee maalgashiga saamiga leverage wuxuu dhuftaa mugga hantida uu haysto isticmaaluhu. Badeecadaha ETF leveraged waxay kordhiyaan faa'iidada iyadoo la kordhinayo isbeddelka qiimaha qiimaha hantida hoose. Saamiga leverage wuxuu ka muuqdaa

2. Badeecadaha ETF leveraged uma baahna ganacsatadu inay dammaanad qaadaan ama amaahdaan.

1.Trading leveraged ETF wax soo saarka uma baahna dammaanad oo waa bilaash. 2.Fixed leverage ratio: Leverage dhabta ah ee qandaraaska joogtada ah wuxuu ku kala duwan yahay isbeddelka qiimaha booska. Jagooyinka alaabta ETF ee leveraged ayaa la hagaajiyaa maalin kasta. Saamiga leverage inta badan had iyo jeer wuxuu joogaa inta u dhaxaysa 3 iyo 5.

Q7: Waa maxay sababta alaabada ETF ee leveraged uga madax banaan yihiin dareerinta?

Maamulayaasha maalgelinta ee Gate.io waxay hagaajiyaan boosaska mustaqbalka si firfircooni leh si badeecadaha ETF ee leveraged ay u sii wataan saami go'an oo leverage ah muddo cayiman. Marka alaabooyinka ETF ee leveraged ay faa'iido leeyihiin, boosaska waa la kordhin doonaa isla markaaba hagaajinta booska. Haddii ay dhacdo khasaare, boosaska waa la dhimi doonaa, si meesha looga saaro khatarta ah in la nadiifiyo. Fiiro gaar ah: Hagaajinta booska waa in la hagaajiyo boosaska qandaraaska ee ka dambeeya alaabada ETF. Hantida lacagta ganacsatadu isma bedesho.

Q8: Goorma ayaa la qorsheeyay hagaajinta booska?

Badeecadaha ETF leveraged 3X: 1. Dib-u-habaynta aan joogtada ahayn: Marka saamiga leverage-ka wakhtiga-dhabta ah uu dhaafo 3, dib-u-dheellitirka aan joogtada ahayn ayaa kicin doona iyo habka hagaajinta booska ayaa hagaajin doona saamiga leverage ilaa 2.3. 2. Dib-u-habaynta joogtada ah: 00:00UTC+8 maalin kasta waa wakhtiga dib-u-dheellitirka caadiga ah. Marka saamiga leverage-waqtiga-dhabta ah uu ka hooseeyo 1.8 ama ka sarreeya 3, ama heerka isbedbedelku (oo lagu xisaabiyo qiimaha qandaraaska) uu ka sarreeyo 1% (sababtoo ah koror weyn ama hoos u dhac ku yimid qiimaha sarifka lacagaha ee 24-kii saac ee la soo dhaafay), booska Habka hagaajintu wuxuu hagaajin doonaa saamiga leverage ilaa 2.3.

Badeecooyinka ETF leveraged 5X: 1. Dib-u-habaynta aan joogtada ahayn: Marka saamiga leverage-ka wakhtiga-dhabta ah uu dhaafo 7, dib-u-habaynta aan joogtada ahayn ayaa kicin doonta iyo habka hagaajinta boosku wuxuu hagaajin doonaa saamiga leverage ilaa 5. 2. Dib-u-habaynta joogtada ah: 00: 00UTC+8 kasta maalinta waa wakhtiga dib-u-dheellitirka caadiga ah. Marka saamiga leverage-waqtiga-dhabta ah uu ka hooseeyo 3.5 ama ka sarreeya 7, ama heerka isbedbedelku (oo lagu xisaabiyo qiimaha qandaraaska) uu dhaafo 1% (sababtoo ah koror weyn ama hoos u dhac ku yimid qiimaha sarifka lacagaha ee 24-kii saac ee la soo dhaafay), booska Habka hagaajinta ayaa hagaajin doona saamiga leverage ilaa 5.

Q9: Waa maxay sababta ay jiraan kharashaadka maamulka?

Alaabooyinka Gate.ios 3S iyo 5S ETF waxay la yimaadaan khidmad maalinle ah oo ah 0.1% khidmadda maamulka maalinlaha ah waxaa ku jira dhammaan kharashyada ku baxa calaamadaha ganacsiga ee leveraged, oo ay ku jiraan maaraynta khidmadaha ganacsiga qandaraasyada, kharashyada maalgelinta, iyo kharashyada kala duwanaanshiyaha qiimaha marka la furayo. boosaska, iwm.

0.03% khidmadda maamulka maalinlaha ah ee lagu dalaco alaabada FTXs ETF kuma jiraan wax khidmadaha kor ku xusan. Tan iyo markii badeecadaha ETF markii ugu horreysay lagu soo bandhigay Gate.io, marka laga reebo ujrada maaraynta ganacsiga booska xisaabinta, khidmadaha maamulka Gate.io ee alaabada ETF ma aysan awoodin inay daboosho dhammaan kharashyada. Gate.io waxay sii wadi doontaa inay bixiso kharashka dheeraadka ah ee isticmaala halkii ay ka qaadan lahayd qiimaha saafiga ah (NAV).

Dhawaan Gate.io waxay soo saari doontaa alaabo ay ka mid yihiin alaabooyinka ETF la isku daray iyo alaabooyinka ETF ee leverage- hooseeya. Iyada oo loo marayo hagaajinta farsamada gaarka ah, waxay si weyn u yareyn karaan kharashyada, ka dhigi karaan ganacsiga mid sahlan oo hooseeya kharashka maamulka.

Q10: Waa maxay sababta qiimaha hantida saafiga ah ee alaabta ETF ee ku dhamaanaysa "BULL" iyo "BEAR" aan loo soo bandhigin?

Alaabooyinka ETF ee ku dhamaanaya "BULL" iyo "BEAR" ma maamusho Gate.io. Gate.io waxay bixisaa oo kaliya adeegyada goob ganacsi mana soo bandhigi karto NAV waqtiga dhabta ah. Fadlan hubi inaad si buuxda u fahamto khataraha ka hor ka ganacsiga alaabta ETF. Kala duwanaanshaha u dhexeeya qiimaha ganacsiga iyo NAV wuu ka weynaan karaa sidii la filayay sababtoo ah qulqulka ku filan suuqa. Alaabooyinka BULL iyo Bear ayaa laga tirtiri doonaa Gate.io dhawaan. Si aad wax badan uga ogaato alaabtan, fadlan tixraac buug-gacmeedyada alaabta FTXs.

Q11: Waa maxay qiimaha hantida saafiga ah (NAV)?

Qiimaha hantida saafiga ah waxa ay ka dhigan tahay qiimaha suuqa saafiga ah ee hay'adda lacagta. Habka xisaabinta NAV: Qiimaha hantida saafiga ah (NAV) = NAV ee dhibicdii hore ee dib-u-dheellitirka (1+ qiimaha is beddelka ee saamiga leverage-currency ee salka ah)

Fiiro gaar ah: NAV barta dib-u-dheellitirka hore waxa loola jeedaa NAV ee boosaska ka dib booska ugu dambeeya hagaajinta.

Qiimaha ganacsiga dhabta ah ee alaabada ETF ee leveraged ee suuqa sare waxay ku qotonta NAV ee lacagta. Waxaa jira leexasho gaar ah oo ka yimid NAV, in kasta oo leexashadu aanu aad u weynayn. Tusaale ahaan, marka NAV ee BTC3L uu yahay $1, qiimaha ganacsiga ee suuqa sare wuxuu noqon karaa $1.01, ama $0.09. Gate.io waxay liis garaysaa NAV ee alaabooyinka ETF ee leveraged iyo qiimaha ganacsi ee ugu dambeeyay isku mar si ay isticmaalayaashu u ogaan karaan khasaaraha ka iman kara marka ay iibsanayaan/ iibinayaan calaamadaha leveraged qiimaha oo aad uga leexanaya NAV.

Q12: Aaway 3-wakhti kor u qaadida qiimaha isbedbedelka ee sida saxda ah uga muuqata alaabada ETF leveraged Gate.ios?

Isbeddelka qiimaha alaabada ETF ee leveraged ayaa ah xoojinta 3-jeer ee isbeddelka qiimaha lacagta hoose, taas oo ka muuqata isbeddelka NAV. Tusaale ahaan, BTC waa lacagta aasaasiga ah ee BTC3L iyo BTC3S. Qiimaha BTC ee wakhti go'an oo ah maalinta ganacsiga (qiimaha 00: 00 waa qiimaha furitaanka) iyo NAV ee muddada u dhiganta waa sida soo socota: Qiimaha BTC wuxuu kor u kacay 1%, NAV ee BTC3L wuxuu kordhiyaa 3%, NAV ee BTC3S ayaa hoos u dhacay 3%; Qiimaha BTC wuxuu ku dhacay 1%, NAV ee BTC3L wuxuu hoos u dhacay 3%, NAV ee BTC3S wuxuu kordhay 3%.

Q13: Sidee loo xisaabiyaa isbedbedelka qiimaha ee alaabta ETF leveraged Gate.ios?

Isbeddellada waxaa lagu xisaabiyaa iyadoo lagu saleynayo NAV. Aan soo qaadano isbedbedelka maalinta gudaheed tusaale ahaan:

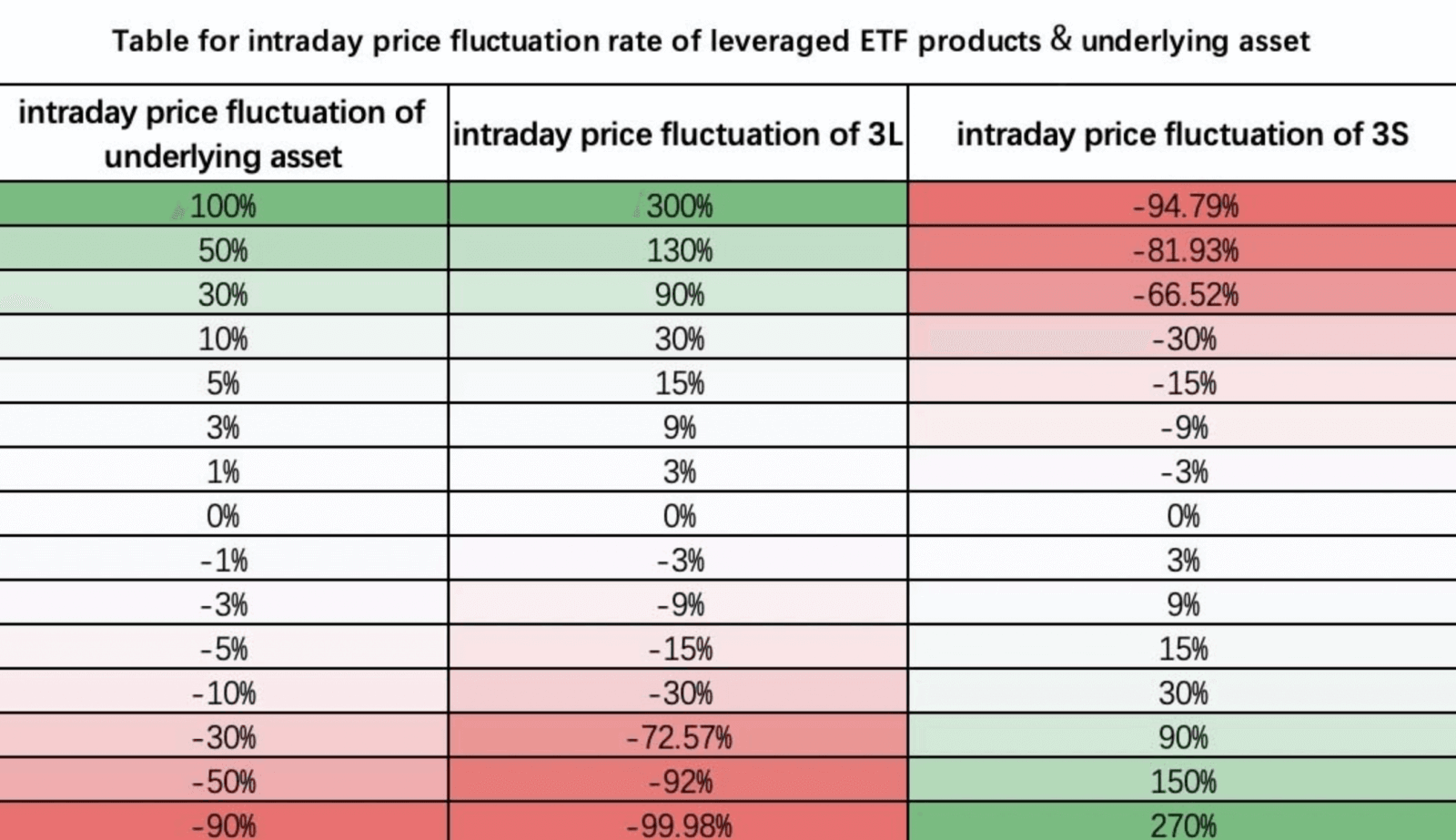

Jadwalka heerka isbedbedelka qiimaha gudaha ee alaabada ETF ee leveraged ee hoos timaada hantida 3L 3S

Q14: Habka hagaajinta boosku (dib-u-dheellitirka) ma kordhiyaa/yaraysaa tirada boosaska?

Maya. Bedelka booska waxaa sameeya Gate.io boosaska qandaraaska si loo ilaaliyo saamiga leverage ee 3. Haysashada booska lacagta la iibiyay waxba iskama beddelin.

Mar kasta oo booska la hagaajiyo, saldhigga xisaabinta ee NAV wuu isbeddeli doonaa. Tusaale ahaan: Marka boosaska lagu hagaajiyo 00:00, NAV waa $1, ka dib NAV barta dib-u-habaynta hore waa $1. Qaaciddada xisaabinta NAV hadda waa $1×{1+ isbeddelka qiimaha lacagta hoose*ee saamiga leverage-ka la beegsanayo}.

Kahor hagaajinta booska soo socda, NAV had iyo jeer waxay ku saleysan tahay $ 1 waxayna isbedeleysaa isbedbedelka lacagta hoose.

Haddii isbeddelka booska aan caadiga ahayn uu kiciyo marka NAV uu noqdo $ 0.7, ka dib hagaajinta, NAV ee dhibcaha dib-u-habaynta hore waxay noqotaa $ 0.7, NAV hadda waxaa loo xisaabiyaa $ 0.7 × (1+ isbeddelka qiimaha lacagta hoose* ee saamiga leverage ee bartilmaameedka ah ).

S15: Waa maxay dib-u-dheellitirka aan joogtada ahayn?

Haddii ay dhacdo isbedbedelka qiimaha ba'an ee suuqa, si looga hortago xayndaabyada qandaraasyada iyo baabi'inta, dib-u-dheellitir la'aanta ayaa kicin doonta.

Kahor 10:00 ee Maarso 16, 2020, Gate.io waxay qabataa heerka isbedbedelka qiimaha 15% (togan ama taban) marka la barbar dhigo barta dib-u-habaynta ee hore oo ah heerka dib-u-habaynta aan joogtada ahayn.

Sababtoo ah suuqa cryptocurrency ayaa ahaa mid aad u kacsan, iyo dib-u-dheellitirka aan joogtada ahayn ayaa si joogto ah u kicisa. Laga bilaabo 10:00 Maarso 16, 2020, Gate.io waxay isticmaali doontaa sicirka isbedbeddelka (togan ama taban) ee 20% marka la barbar dhigo barta dib-u-habaynta ee u dambaysa sida marinka.

Hagaha Alaabta ETF Leveraged (Cutubka II)

Waa maxay shuruudaha suuqa ee wax soo saarka ETF laga faa'iidaysto?

Alaabooyinka ETF ee leveraged waxay leeyihiin faa'iidooyin suuqyo hal dhinac ah. Waxa jira kharashyo is-khilaafsan oo badan oo suuqyada labada dhinac ah. Aan soo qaadano BTC3L tusaale ahaan si aan u ilaalino faa'iidada alaabooyinka ETF ee leveraged ee ku jira shuruudaha suuqa kala duwan: * 3xBTC waxaa loola jeedaa 3-waqti caadiga ah ee BTC_USDT qandaraas joogto ah

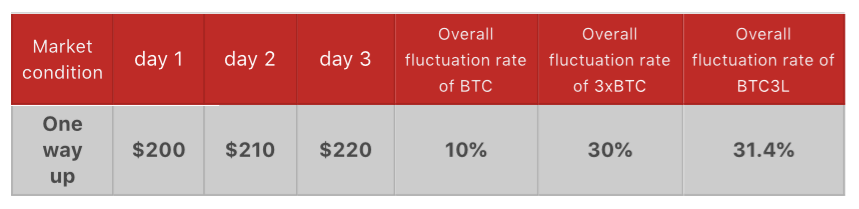

l Suuq hal dhinac ah: hal dariiq oo kor loogu qaadayo

"hal hab kor" seenyo, leveraged Alaabooyinka ETF waxay ka fiican yihiin qandaraasyada joogtada ah ee 3-jeer ee caadiga ah (3xBTC). Hoos waxaa ku yaal sida loo xisaabiyo faa'iidada:

Maalinta ugu horreysa, qiimaha hal BTC wuxuu ka kacay $ 200 ilaa $ 210, heerka isbeddelka waa + 5%. NAV (qiimaha hantida saafiga ah) ee BTC3L waxa ay noqotaa $200(1+5%× 3)=$230;

Maalintii labaad, qiimaha hal BTC wuxuu ka kacay $ 210 ilaa $ 220, heerka isbeddelku waa + 4.76%. NAV ee BTC3L waxa ay noqotaa $230× (1+4.76%× 3)=$262.84;

Gebagebadii, heerka isbedbedelka 2-dan maalmood waa ($262.84 - $200)/$200*100% = 31.4%, taasoo ka badan 30%.

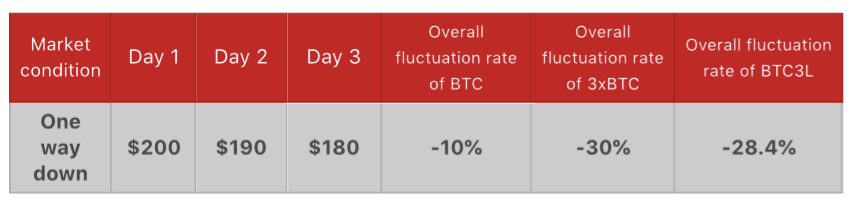

l Suuq hal dhinac ah: hal dariiq oo hoos u dhacaya

Xaaladda "hal dariiqo hoos u dhac", khasaaraha ka soo gaaray alaabada ETF ee leveraged ganacsigu wuu ka yar yahay ganacsiga qandaraaska. Hoos waxaa ku yaal sida loo xisaabiyo khasaaraha:

Qiimaha BTC wuxuu ku dhacayaa 5% maalinta ugu horeysa. NAV ee BTC3L waxa ay noqotaa: $200 (1-5%×3)=$170;

Qiimaha ayaa mar kale hoos u dhacay maalinta labaad iyo heerka isbedbedelku waa -5.26%. NAV ee BTC3L waxay noqotaa $170 (1-5.26%×3)=$143.17;

Guud ahaan heerka isbedbedelka 2dan maalmood waa ($143.17 - $200)/$200*100%= -28.4%, taas oo ka badan -30%.

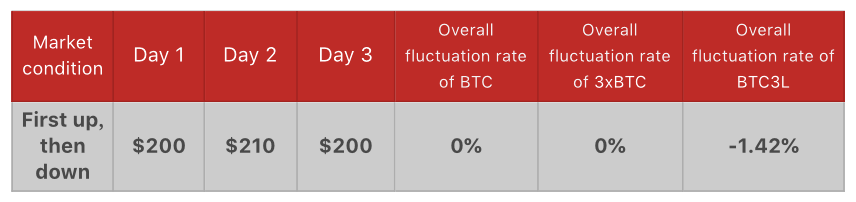

l Suuqa laba-dhinac ah: marka hore kor, ka dibna hoos u dhaca

Haddii qiimaha BTC uu marka hore kor u kaco, ka dibna dib ugu soo laabto heer isku mid ah, ka dibna alaabooyinka ETF ee leveraged ma qabtaan wax faa'iido ah qandaraasyada joogtada ah.

Maalinta ugu horeysa, qiimaha hal BTC wuxuu ka kacayaa $ 200 ilaa $ 210, heerka isbeddelku waa + 5%. NAV ee BTC3L waxa ay noqotaa $200(1+5%× 3)=$230;

Maalintii labaad, qiimuhu wuxuu hoos uga dhacay $210 ilaa $200, heerka isbedbedelku waa -4.76%. NAV ee BTC3L waxa ay noqotaa $230(1-4.76%× 3)=$197.16;

Guud ahaan heerka isbedbedelka 2dan maalmood waa ($197.16 - $200)/$200*100%=-1.42%, taasoo ka yar 0%.

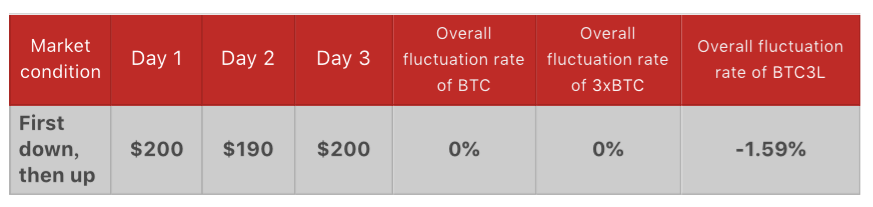

l Suuqa laba-dhinac ah: marka hore hoos, ka dibna kor

La mid ah xaaladda kor lagu sharraxay, haddii qiimihiisu marka hore hoos u dhaco, ka dibna kor u kaco si sax ah heer isku mid ah, alaabooyinka ETF ee leveraged ma aha maalgashi ku habboon.

Maalinta ugu horeysa, qiimaha BTC wuxuu ku dhacayaa 5%. NAV ee BTC3L waxay noqotaa $200 (1-5%×3)=$170;

Maalintii labaad, qiimuhu wuxuu dib uga kacay $190 ilaa $200. heerka isbedbedelku waa +5.26%. NAV ee BTC3L waxa ay noqotaa $170 (1+5.26%× 3)=$196.83;

Guud ahaan heerka isbedbedelka 2dan maalmood waa ($196.83- $200)/$200*100%=-1.59%, taasoo ka yar 0%.

Fadlan ka digtoonow: Badeecadaha ETF ee leveraged waa faa'iidooyin dhaqaale oo leh khataro sare. Maqaalkani waa in kaliya loo tixgeliyo falanqayn kooban halkii laga isticmaali lahaa talo kasta oo maalgashi. Isticmaalayaashu waa inay si fiican u fahmaan badeecadaha iyo khatartooda ka hor ganacsiga.